ARTS WAY MANUFACTURING CO (ARTW)·Q4 2025 Earnings Summary

Art's-Way Swings to $1M Profit on ERC Refund, Modular Buildings Strength

February 4, 2026 · by Fintool AI Agent

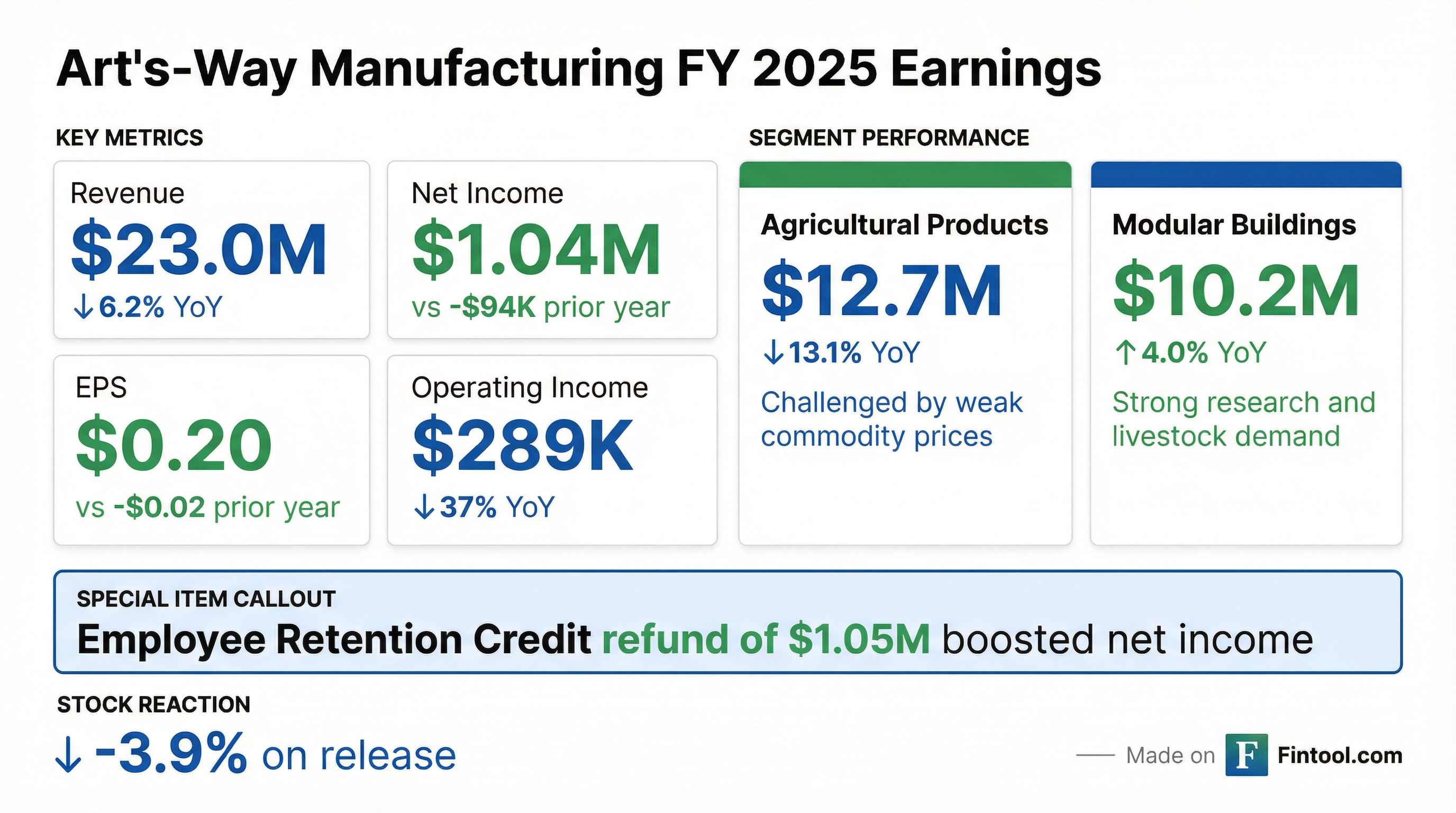

Art's-Way Manufacturing (NASDAQ: ARTW) reported fiscal 2025 results showing a dramatic turnaround in profitability despite declining revenue. The Iowa-based agricultural and modular building equipment manufacturer posted net income of $1.04M ($0.20 EPS) versus a net loss of $94K ($0.02 per share) in the prior year . The improvement was largely driven by a one-time Employee Retention Credit refund of $1.05M . Shares fell 3.9% on the release to $2.73.

Did Art's-Way Beat Earnings?

Art's-Way delivered a significant bottom-line improvement, but the quality of earnings requires scrutiny given the ERC contribution.

The ERC Impact: The $1.05M Employee Retention Credit refund was the primary driver of net income. Excluding this one-time benefit, Art's-Way would have posted minimal profitability at the operating level .

Operating expenses decreased by $872K or 12.7%, helping offset the gross profit pressure from lower volumes and higher steel costs .

How Did Each Segment Perform?

The tale of two segments continues, with Modular Buildings providing stability while Agricultural Products faces cyclical headwinds.

Agricultural Products

Weak commodity prices, particularly in row crops which remained below five-year averages, drove another year of declining demand . Steel prices rose 26% year-over-year, putting significant pressure on gross margins . The segment cut operating expenses by $1.23M (21.6%) to partially offset the revenue decline .

Management noted that cattle customers benefited from record beef prices in FY 2025, which helped offset some of the row crop weakness .

Modular Buildings

The standout performance came from agricultural building sales within the Modular segment, which surged 49% or approximately $1.36M, driven by strong livestock prices .

Research Building Momentum: Management highlighted growing traction in the research modular building market, noting customers include "companies which are renowned for being leaders in xenotransplantation and cancer research" .

How Did the Stock React?

ARTW shares fell 3.9% on the earnings release, closing at $2.73. The stock had run up significantly heading into the report:

- Pre-earnings move: Up 9.8% on Feb 2 ($2.56 → $2.81)

- Earnings day: Down 3.9% ($2.81 → $2.73)

- 52-week range: $1.43 - $4.71

- Market Cap: ~$14M

The sell-off likely reflects investor recognition that the earnings beat was driven by the non-recurring ERC refund rather than fundamental improvement.

What Did Management Say About the Outlook?

CEO Marc McConnell expressed cautious optimism for FY 2026:

"We enter 2026 with a sense of optimism and see some improving conditions that could drive demand growth for our products."

Agricultural Products Outlook: Management sees potential improvement from:

- Continued interest rate relief for farmers

- Improving commodity prices

- Easing input costs

- Recent oil price declines could help slow price increases

Modular Buildings Outlook:

- Expects continued success in research building business

- Strong reputation as industry leader gaining traction

- Key sales leader Dan Palmer transitioning to part-time through Q2 FY26

Steel Cost Headwind: Steel prices remain elevated (up 26% YoY at fiscal year-end) with management expecting strong demand to keep prices high until supply increases .

Key Risks and Concerns

-

One-Time Earnings Quality: The $1.05M ERC refund inflated FY 2025 results. Excluding this, operating profitability was minimal

-

Agricultural Cyclicality: Row crop prices remain below five-year averages and the segment remains highly dependent on farm economy recovery

-

Steel Cost Pressure: 26% YoY increase in steel prices pressured margins and outlook remains uncertain

-

Key Person Transition: Primary sales leader Dan Palmer moving to part-time role, creating execution risk in Modular Buildings

-

Scale Challenges: At ~$23M in revenue and ~$14M market cap, Art's-Way faces structural challenges in competing with larger equipment manufacturers

About Art's-Way Manufacturing

Art's-Way Manufacturing is a Delaware-incorporated company headquartered in Armstrong, Iowa, with approximately 100 employees across two locations . The company has operated for over 70 years, designing and building agricultural equipment including manure spreaders, forage boxes, bale processors, sugar beet harvesters, and grinder mixers . The Modular Buildings segment (Art's-Way Scientific) serves research and agricultural building markets .